Bitcoin vs the Empire

- rodicarsone

- Apr 29

- 2 min read

The Hidden Risk Beyond the 2025–2026 Bitcoin Crash

Here’s the core idea:

After this next cycle (the one we’re in right now),

Bitcoin may never behave normally again.

Not because it dies, but because it enters open conflict with the global monetary system.

Why?

Because nation-states, especially the U.S., China, and the E.U. are preparing to roll out Central Bank Digital Currencies (CBDCs).

These CBDCs will digitize fiat currencies.

They will be programmable (they can control how and where money is spent).

They will allow for absolute surveillance of financial transactions.

They will redefine sovereignty — not just politically, but economically.

And Bitcoin is the most prominent threat to that control.

Imagine their view:

If Bitcoin is allowed to grow unchecked,

it undermines their monopoly on issuing, controlling, and taxing money.

It removes the ability to freeze accounts easily.

It limits their tools for monetary policy and sanctions.

It creates an alternative financial world — one they don’t govern.

That’s unacceptable to an empire that survives on controlling money.

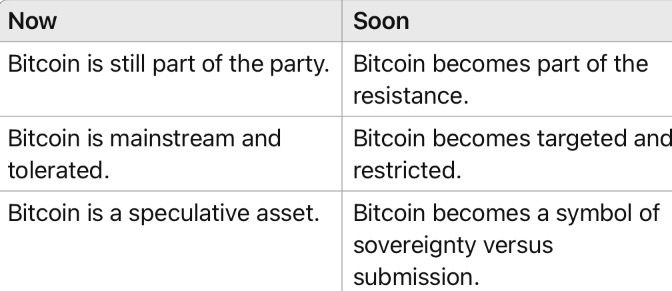

The Coming Collision Timeline

What Happens to Bitcoin Then?

Here’s the dark possibility:

It survives, because it’s decentralized and hard to kill.

But it loses liquidity, becomes harder to move legally, and gets siloed into black/gray markets.

Large exchanges will be heavily regulated or shut down unless they enforce full KYC (know your customer), tracking, and reporting.

Holding Bitcoin won’t be banned outright — but using it might be severely restricted unless compliant.

In other words:

Bitcoin could become a kind of financial contraband; still alive, but driven underground.

What Nobody is Saying Out Loud (Yet):

The fight won’t be just Bitcoin versus banks.

It will be Bitcoin versus the architecture of control itself.

It’s a philosophical and practical war about who gets to define money in the 21st century.

And very few are ready for that battle.

Most are still stuck on price predictions, memes, and ETFs.

One Final Thought:

When the 2025–2026 crash comes,

many will walk away bitter.

Many will say Bitcoin was just a fad.

Many will move to CBDCs without thinking.

But a few, those who understand what Bitcoin actually represents beyond price, will quietly hold on, adapt, and build the next layer of freedom-resistant systems.

Bitcoin may not die.

It may become what it was always meant to be:

dangerous.

Comments